United Overseas Bank (UOB) increased retail banking income contribution by 15% as the financial industry grapples with digital advancement. The bank leveraged its omni-channel customer engagement model which helped grow retail deposits by 7% year on year. The bank continued to invest in digital transformation and innovation which resulted in 96% of all transactions being conducted digitally in 2019.

September 14, 2020 | Janine Marie Crisanto- UOB bolstered its 20% market share in retail deposits and loan products despite stiff competition

- The bank exhibited the best cost management among its peers in growing its franchise

- Its products received high net promoter scores in the BankQuality survey and rankings

This year’s assessment of the Best Retail Bank in Asia Pacific was disrupted and delayed by the COVID-19 pandemic. To ensure the rigor and comprehensiveness of the evaluation, the assessment was expanded to consider banks’ response to the pandemic. In addition, it also incorporated customer derived net promoter score-based ratings from the BankQuality consumer survey on retail banks, including how they helped customers during the COVID-19.

The Singapore banking industry has been dominated by the three main domestic banking groups – DBS Group, Oversea-Chinese Banking Corporation (OCBC), and United Overseas Bank (UOB), accounting for the majority of customer pool and up to 70% share of consumer loans and deposits. They face fierce competition from 11 qualified full banks that vie for a slice of the lucrative retail finance and wealth management market, albeit with restrictions on the number of locations that they can operate from.

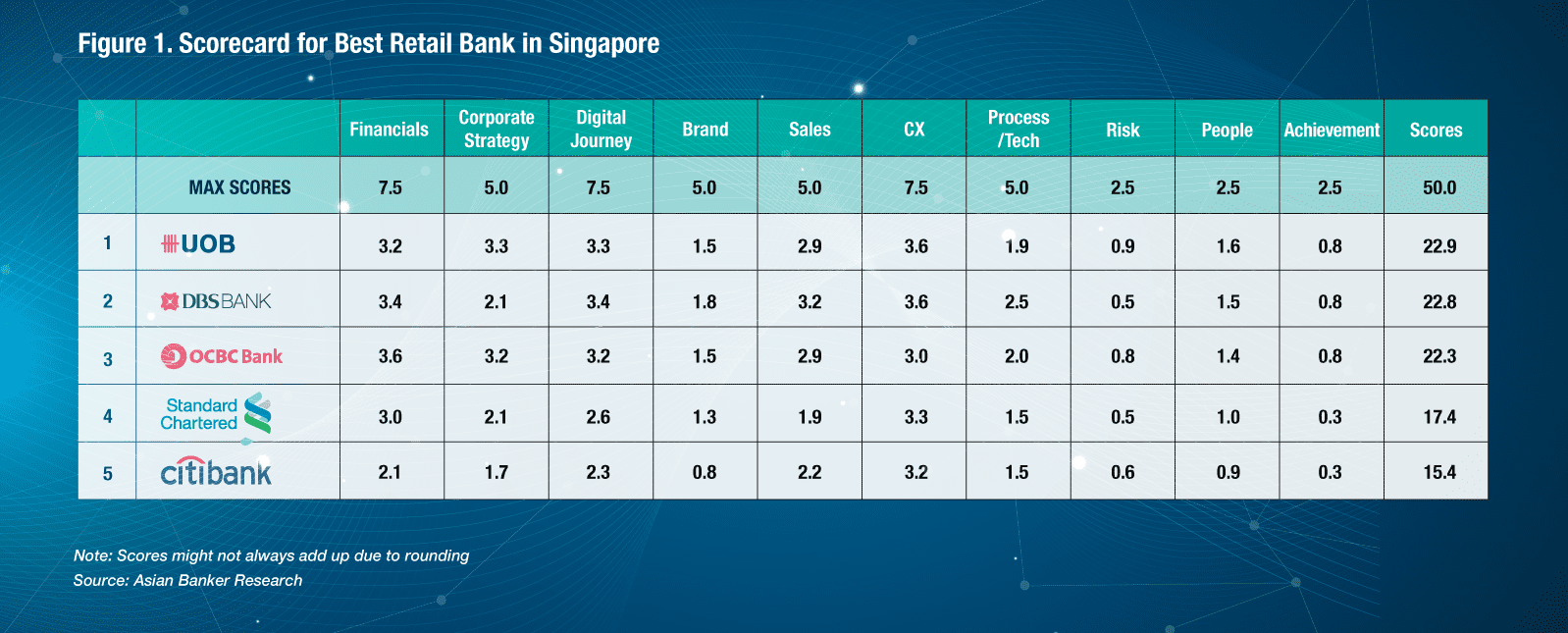

In this year’s assessment of Best Retail Bank in Singapore based on the evaluation scorecard, UOB emerged as the top retail bank for its sustaining its key market position and strong performance in digital journey and customer experience.

Brand and Sales: UOB bolstered its 20% market share in retail deposits and loan products despite stiff competition

The largest bank in the country, DBS Bank through its high-street POSB franchise, has a dominant share of the domestic retail deposit market with an estimated market share of over 35% and leading position in wealth ...

Categories:

Keywords:Digitalisation, Digital Bank, Mortgage, Covid-19