Lovney said in order to help foster the ecosystem and drive volume on the platform, NPP Australia are developing standards for structured data in a number of high priority areas such as superannuation, payroll and e-invoicing

February 06, 2019 | Chris Kapfer- NPP Australia are developing standards for structured data in a number of high priority areas

- OSKO, the first developed service on top of the NPP, will include the ability to attach a document with a payment or have a url link to externally hosted documents included in the message

- NPP 2.0 will cover additional sample APIs

Australia’s real time payments platform NPP, which launched in February 2018 and has been developed and funded by thirteen of the largest financial institutions will add in 2019 further functionalities and develop standards for structured data.

NPP enables consumers, businesses and government agencies to make real-time, data-rich payments between accounts from participating financial institutions. .

“Our focus in 2019 will be on extending the number of accounts able to access the NPP beyond the nearly 51 million accounts currently connected via one of 72 Australian financial institutions, so that more Australians can send and receive fast, data-rich payments,” said Adrian Lovney, CEO, NPP Australia.

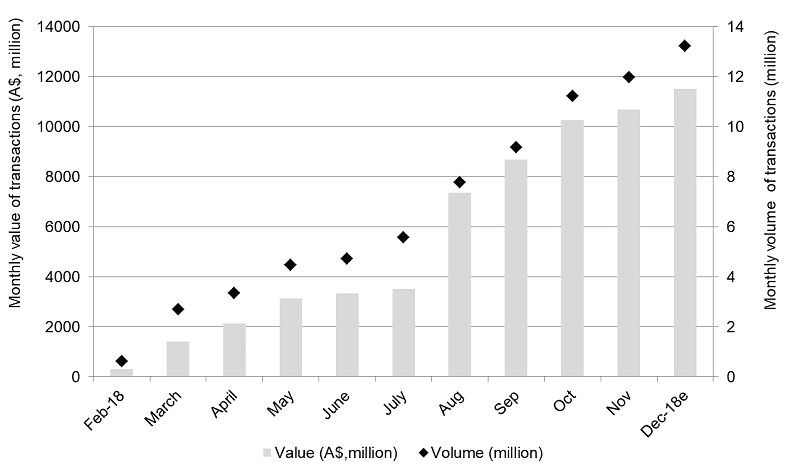

Cumulative volume of transaction between February and December 2018 expected to reach 74 million, according to Asian Banker Research

Fig 2 Monthly Value and Volume of Transactions (non-cumulative)

Source:Asian Banker Research, RBA

Most banks are offering these payments via Osko – the first developed service on top of the NPP platform. Developed by BPAY Group, Osko taps into the Platform’s real-time clearing and data capabilities to deliver instant account-to-account payments service.

“Osko request and payment with a document future iterations of the Osko service, which are already under development, will include “request to pay” functionality and the ability to attach a documen...

Categories:

Keywords:Institutions, Fintech, API, Technology, SWIFT