Australian households are struggling with the record amount of outstanding debt, and the sliding housing market fuels concerns over shrinking economic growth in the country. In addition, the rapid build-up of household debt in China continues to attract attention

June 27, 2019 | Wendy WengHigh or rising household debt level remains a constant source of worry in Asia Pacific, which poses risks to economic growth and financial stability. Concerns intensify in many countries as disposable income growth is slower and the economic condition is unfavourable.

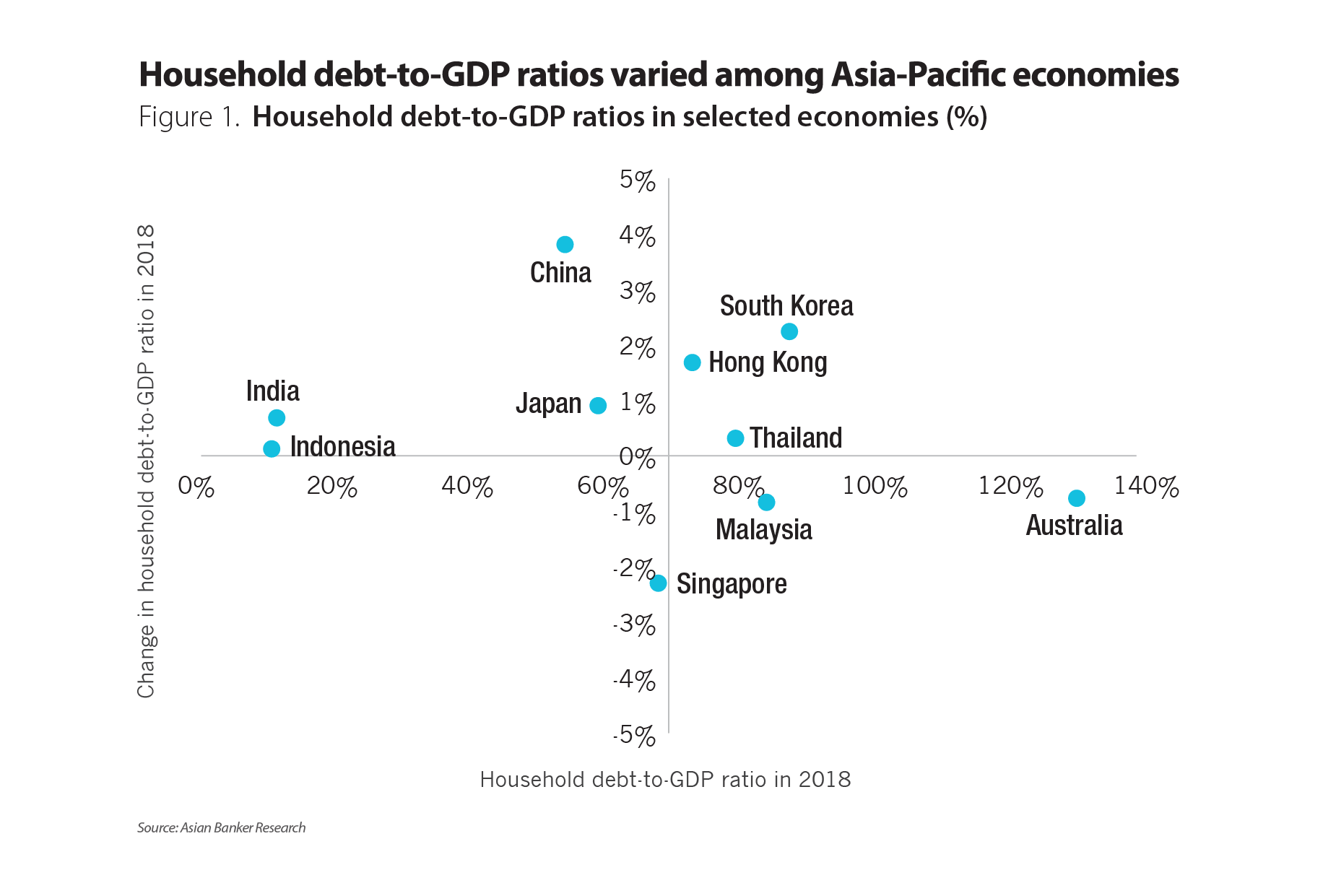

Advanced economies tend to have higher ratios of household debt to gross domestic production (GDP). Among the economies we study, Australia has the highest household debt-to-GDP ratio (Figure 1), followed by South Korea, Malaysia, and Thailand. China has witnessed the fastest household debt growth. Household debt problem has resulted in reduced savings or spending in these countries, which is placing the economy under pressure. Household debt also has cast uncertainty on the health of these countries’ financial systems.

Concerns remain in Australia despite slower household debt growth

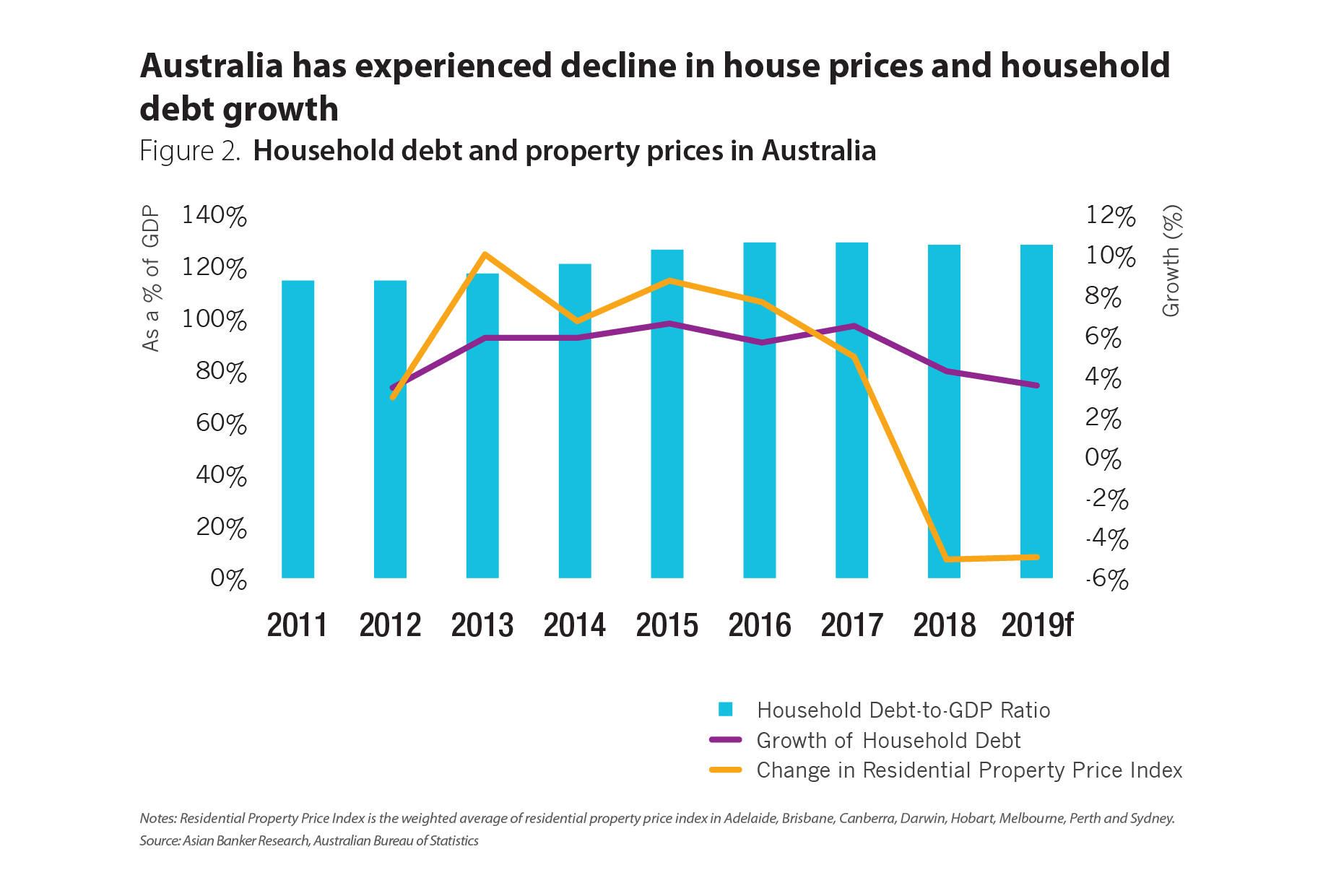

In Australia, household debt as a share of GDP has reached a record high in 2017 (Figure 2), which can be largely attributed to overvalued housing market. Banks have been ordered to impose tougher standards for granting mortgages, which has curbed investment loans and driven home values down. In addition, the Australian property sector was also affected by the restrictions on foreign property buyers in Australia and capital control in China. In 2018, house prices fell substantially in many of Australia’s largest capital city markets. Meanwhile, the growth of household debt decelerated and household debt-to-GDP ratio edged down.

Nevertheless, the house price correction has raised concerns over the housing market slowdown and its impact on household consumption and the economy. The cooling...

Nevertheless, the house price correction has raised concerns over the housing market slowdown and its impact on household consumption and the economy. The cooling...

Categories:

Keywords: