The center of debate has shifted from whether impact investing can match the returns of traditional investing, to whether asset owners are willing and how many asset managers are skilled and inclined to put in the extra diligence needed to ensure positive impacts for similar returns.

February 24, 2020 | Chris Georgiou- Impact assets – dominated by specialist asset managers – comprise a tiny fraction of global sustainable strategies

- Family offices are ideally placed to match impact and returns but relative deal volume is low as philanthropy remains strong

- Overcoming two-fold measurement challenges regarding both deal flow and output of impact essential to advancing industry

Impact investing, the strongest form of sustainable investment, is gaining wider attention from a very low base. But perceptions on lack of deal flow, difficulties in measuring market size and impact plus the absence of common standard as well as the need for secondary markets are all dragging the industry development down, although growing sustainability concerns will accelerate progress.

While diverse, impact investing continues to mature in terms of both measurement the management of the financial and impact performance of assets, yet the ‘visible heart’ needs futher tools to guide the invisible hand of the market.

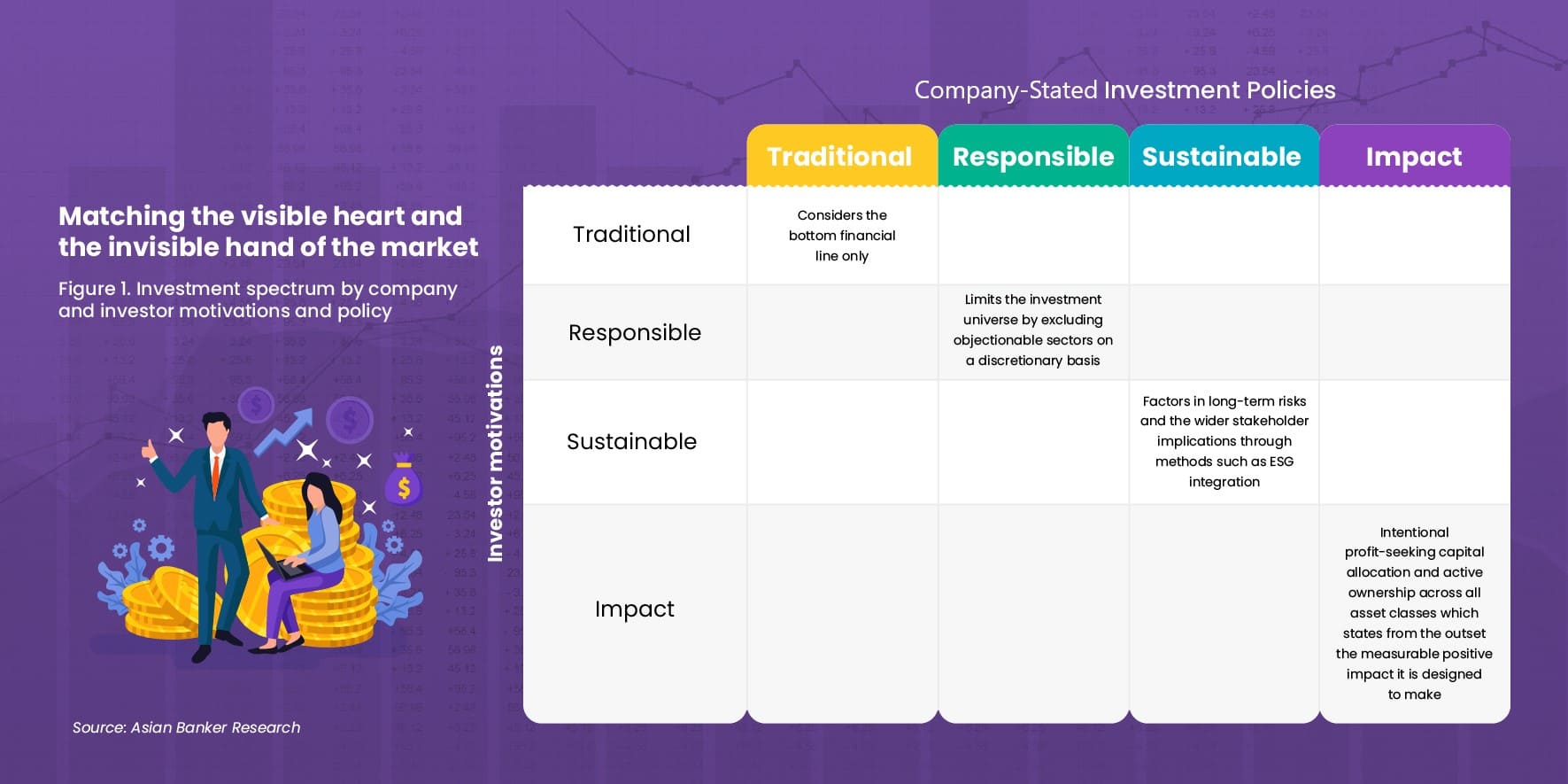

Investments can be broadly categorised into four approaches: Traditional, responsible, sustainable and impact, with each further comprised of a diversity of strategies, financial tools and risk profiles.

Traditional investments only consider the bottom financial line, while responsible approaches limit the investment universe by excluding objectionable sectors on a discretionary basis. Sustainable investments factor in long-term risks and wider stakeholder implications of investments through methods such as environmental, social and governance (ESG) integration.

Impact investing on the other hand is a risk-adjusted, intentional, profit-seeking capital allocation and active ownership across all asset classes by institutions and individuals, which states from the outset the measurable positi...

Categories:

Keywords: