The growth in financial services has been remarkable over the past few years in India and the financial sector has witnessed a transformation with the introduction of fintech. Let us take a glimpse of key fintech segments that affect man - digital payments, insurtech and wealthtech.

May 25, 2021 | Krupesh Thakkar- India, the world’s biggest real-time and digital payments market registered over 25 billion transactions in 2020

- Insurance penetration remains low at 4%

- Opportunities seen in wealthtech and robo-advisory

Financial services are the economic products and services provided by financial institutions that cater to fund raising, deployment, management, personal finance management, and specialised services which are regulated by plethora of legislation and regulators. Fintech has brought various innovative offerings across payments and transfers, financing and banking, and capital markets and personal financial management.

The phenomena of India’s fintech industry growth are evident and estimated to inch up to $150 to $160 billion by 2025 from current value of $50 to $60 billion, according to the report “India Fintech: A $100 billion opportunity” published by Boston Consulting Group (BCG) and FICCAI.

Popularly advertised as “faceless, paperless, cashless” digital payment is one of the flagship programmes of the government of India to make it a digital economy. Before the introduction of latest tools like unified payments interfaces (UPIs) and digi-wallets, India had several methods for faster payments such as debit and credit cards, national electronic funds transfer (NEFT), real-time gross settlement (RTGS), and immediate payment service (IMPS).

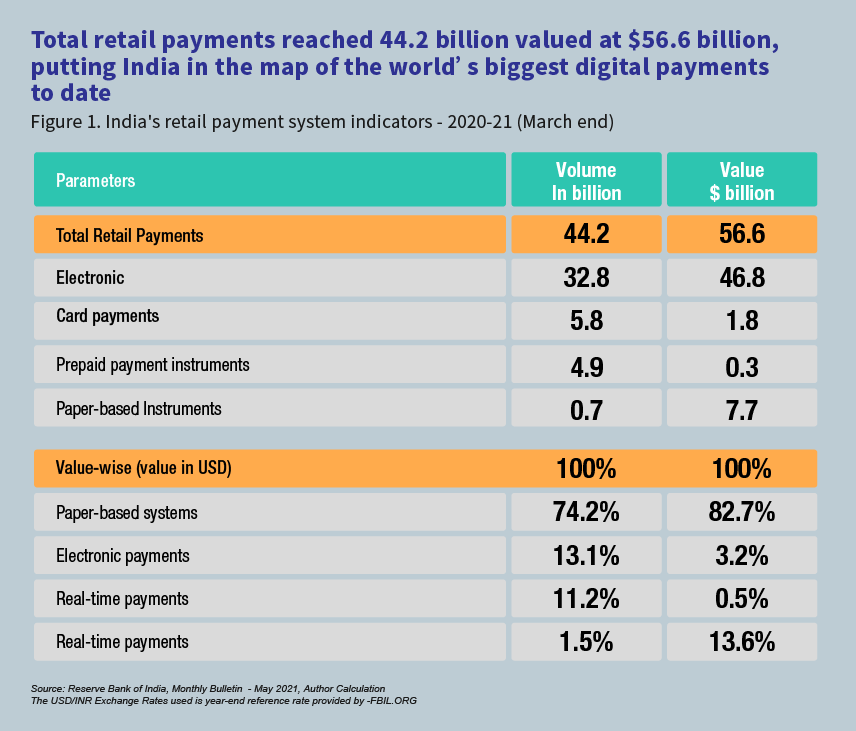

Total retail payments reached 44.2 billion valued at $56.6 billion, putting India in the map of world’s biggest digital payments to date

India holds the world’s biggest real-time, digital payments record

In India, the share of electronic payments is already significant in both volume and value terms as evidenced by the latest statistics of India’s retail payment system indicators (Figure 1). India has in...

Categories:

Keywords:Fintech, Digital Payments, Insurtech, Wealthtech, Financial Markets, Mobile Wallets, E-KYC, UPI, API, Foreign Direct Investment