Despite fierce competition from its local South African peers and some Nigerian banks, Absa emerged as the Best Retail Bank in Africa

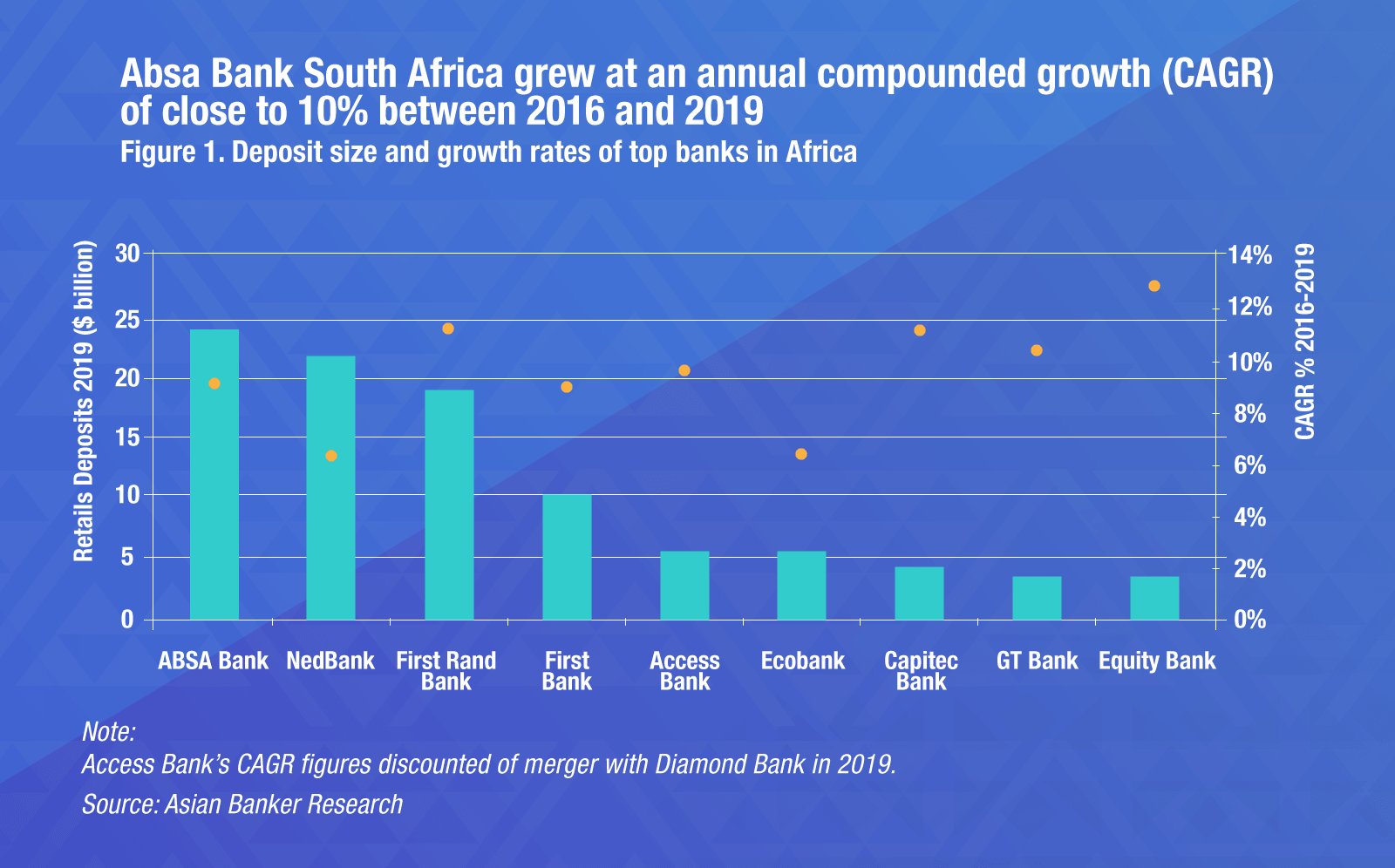

January 15, 2021 | Chris KapferAbsa Bank is one of Africa’s largest diversified financial services groups with presence in 12 countries across the continent and around 42,000 total employees. With close to $3 billion in annual retail revenue and 632 branches as of 2019, the bank is the largest retail bank in South Africa having grown its retail deposits by a compounded annual growth rate of 9.6% between 2016 and 2019.

Absa Bank’s newfound sense of ownership and growth

Its historical decision to split from the global Barclays group network in 2018 was equally bold as it was necessary. The bank had gradually been ceding market share to its peers in core retail categories such as credit cards and mortgages and could not optimise its large network size and capital structure in an emerging market. When it set out in 2018 a new business strategy and operating model around entrepreneurial ideas, innovation, ownership and faster implementation, it became less of a capital and cost-driven business rather than a growth business. While sustainable growth to be driven by a transformative culture will not come back overnight, 2019 saw the first glimpse that a mix of newfound ownership, entrepreneurial spirit and innovation could see the beginning of a material impact on its income and balance sheet. The pandemic put a temporary stop to those ambitions, but Absa remains resilient in the current COVID-19 pandemic. In the first half of 2020, home loans registrations were down 31% while the market contracted by 39%. Vehicle and asset financing decreased 19% in a market that shrunk by 42% but it showed solid net insurance premium growth of 9%.

Shift from sales conversations to focus on client relationships

Focus on the total relationship in client conversations is paramount to integrity and customer loyalty in the long term, altho...

Categories:

Keywords: