The Japan-based messaging app shares its vision to the world during the recently-concluded LINE Conference 2019: To grow from a mere messaging app into a full-fledged lifestyle platform, which will cover all the needs of its users

August 07, 2019 | Chris Kapfer- LINE has currently around 187 million monthly active users on a global scale.

- Globally, registered payment users grew from 40 million in November 2017 to 48.3 million by June 2019

- Thailand will become a key battleground between LINE and Alipay and the litmus test as to which player have what it takes to win the customer mandate

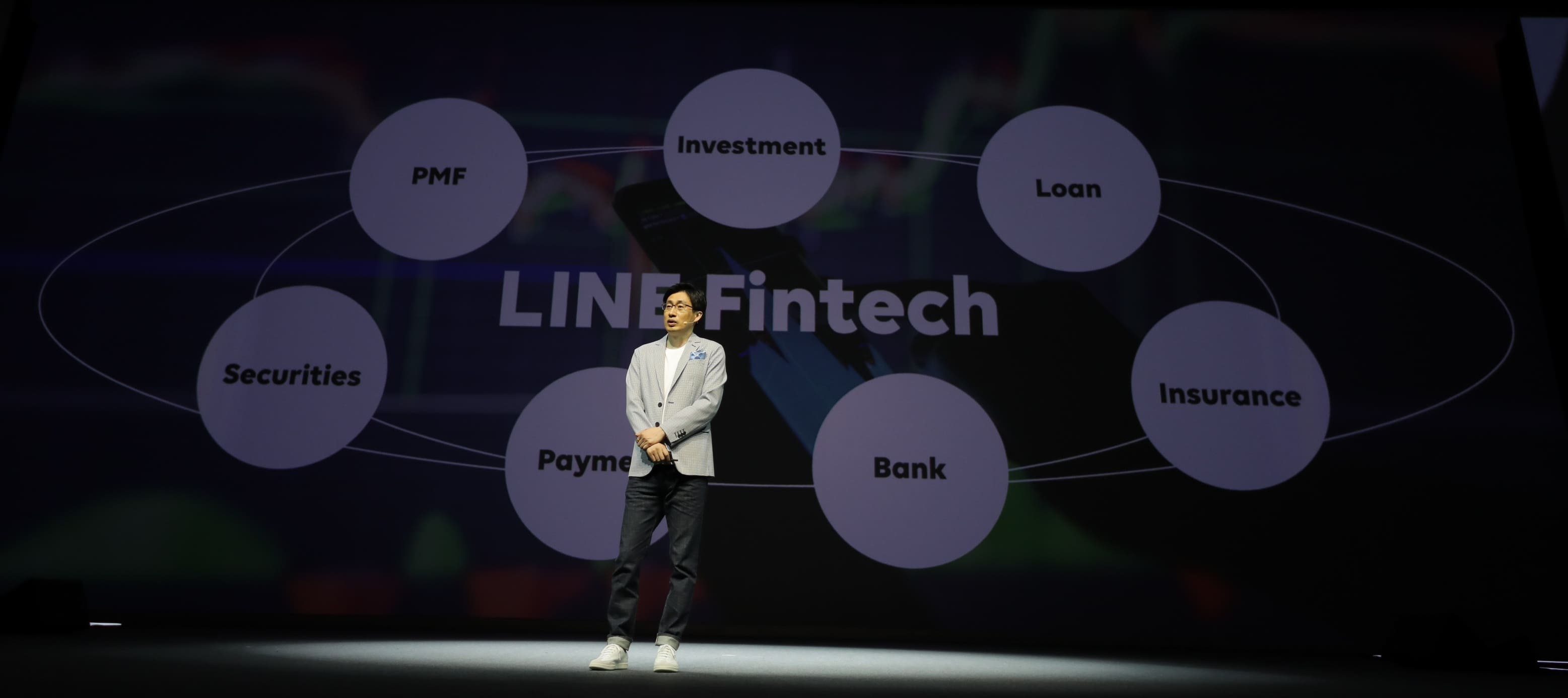

In its most crucial venture to date, LINE aims to grow into a comprehensive financial service provider in the region and is preparing to launch its ‘smartphone bank’ across four markets most possibly in the next 24 months, supported by its mobile payments platform LINE Pay. LINE has currently around 187 million monthly active users on a global scale.

Globally, registered payment users grew from 40 million in November 2017 to 48.3 million by June 2019, according to LINE.

“If we don’t upgrade finance, our lives will never be complete,” highlighted Shin Jungho, its co-CEO and chief WOW officer at the conference. He further added, “When we launch a new business, we focus on pain points such as fees to move money and paperwork. We look at the big scope of pain points when we look at business opportunities.”

At this year’s conference, LINE co-CEO Jungho Shin revealed their new vision, 'Life on LINE', under which LINE will pursue “WOW” by becoming a “life infrastructure” that leverages lifestyle innovations to support all aspects of users’ lives 24/7.

In Japan, LINE News grew from 14 million page views as of July 2013 to 10 billion page views as of the end of May 2019. And with 80 million of messaging app users in Japan, it is the number one news and content platform there. It also has grown into the number one payments app based on the number of transactions in Taiwan.

LINE Pay strengthened its position in those markets but ...

Categories:

Keywords: