The Asia Pacific banking sector will benefit from the improving global and regional economic conditions in 2018. Overall, better asset quality is expected, and banks will maintain relatively stable profitability and capitalisation. Nevertheless, there are growing concerns over the potential asset price corrections, high private debt, and geopolitical risks.

February 05, 2018 | Wendy Weng- Banks’ asset quality metrics is expected to improve moderately in 2018

- Tighter regulations, including those on banks’ interbank investment and financing and off-balance sheet assets, will hit Chinese banks’ income, especially for smaller banks

- IFRS 9 will increase banks’ risk management capabilities and model sophistication and improve transparency

Despite the improving economic conditions in the world economy, numerous risks continue to weigh on the global outlook. According to Goldman Sachs’ latest global economic outlook report, the bigger risks to the world economy are likely to be political.

Escalating tensions on the Korean peninsula, instability and insecurity in the Middle East and ongoing Brexit negotiation will pose challenges for the global economy. In addition, there have been troubling signals from the US against global or multilateral trade agreements, with the Trump Administration’s decision to pull out of the Trans-Pacific Partnership and renegotiate the North America Free Trade Agreement. While its exact strategy remains unclear, this seems to have galvanised the rest of world to strengthen regional as well as bilateral trade cooperation.

In 2018, the synchronised global growth looks set to continue and major economies in the Asia Pacific region will also continue to benefit strongly from the global upturn in international trade. Asia Pacific will remain the most dynamic region and will continue to lead global growth.

The financial profiles of Asia Pacific banking sector are expected to be sound overall in the context of gradually improving operating environment. The profitability of the banking sector is expected to be relatively stable, mainly due to the expected interest rate hikes, better asset quality and the recovery in bank lending growth. The improved economic backdrop has helped stabilise banks’ asset quality, and the substantial pressures on banks’ asset quality is expected to ease further in 2018. Meanwhile, the capital levels of banks in most markets will remain adequate, despite the impact of the implementation of International Financial Reporting Standard (IFRS) 9. The banking sector will also maintain relatively strong funding and liquidity positions, as banks are primarily funded by deposits.

“Solvency metrics will be stable in most of the banking systems rated by Moody’s in Asia Pacific, driven by a synchronised global recovery and moderate credit growth,” said Eugene Tarzimanov, vice president and senior credit officer for Moody’s financial institutions group. He also mentioned that banks’ capital buffers strengthened due to moderate growth in risk weighted assets and more stringent regulatory requirements, and bank profitability will slowly recover in 2018, as credit costs and net interest margins stabilise.

Moody’s expects that governments in the region will remain supportive of the banks, which provides uplift for senior unsecured and deposit ratings. Most economies are unwilling to introduce burden sharing through statutory bail-in for senior creditors, with the exception of Hong Kong.

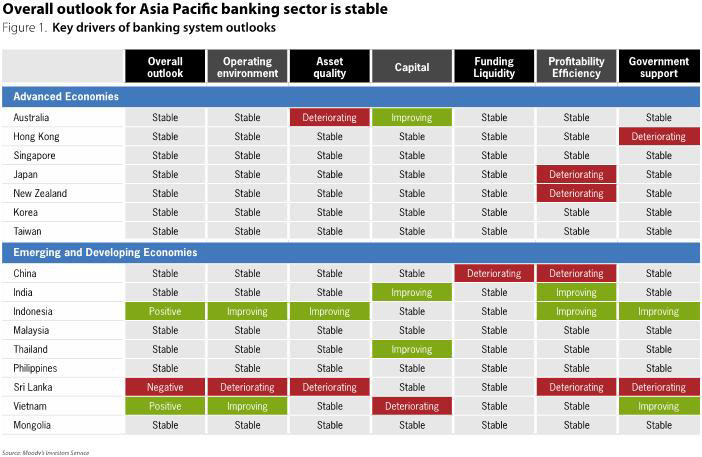

Of the 16 banking systems in Asia Pacific analysed by Moody’s, two have positive outlooks, one negative and the remaining 13 stable (Table 1). The systems with stable outlooks in the advanced economies are Australia, Hong Kong, Singapore, Japan, New Zealand, Korea and Taiwan; and for the emerging and developing economies, China, India, Malaysia, Thailand, the Philippines and Mongolia. Indonesia and Vietnam have positive outlooks, and Sri Lanka negative.

Although the prospects for Asia Pacific banking sector is positive, concerns remain, due to a combination of factors such as elevated levels of private sector leverage, the potential for sharp corrections in asset prices and geographic conflicts.

Better asset quality

In 2018, banks’ asset quality metrics is expected to improve moderately, on the back of supportive macroeconomic environment and the governments’ continuous efforts to contain financial risk. Meanwhile, banks in the region maintain sufficient loan loss reserves, and they are required to set aside more provisions to cover expected future credit losses under IFRS 9.

The official figures show that the loan quality of Chinese banks was better in 2017, and the trend is expected to continue in 2018. The lower non-performing loan ratios banks recorded can be largely attributed to the improved corporate sector performance, the acceleration of bad debt write-offs and transfers to third-party asset managers and regulatory measures such as securitisation of bad assets and debt-for-equity swaps. Gary Ng, Natixis’ economist for Asia Pacific, also said that Chinese banks’ risks will continue to be shared with the rest of the financial sector, and this should help asset quality in banks’ balance sheet.

The recovery in commodity prices has reduced strains in resource-linked sectors, which will continue to support the asset quality of banks in countries like Singapore and Indonesia. Indian banking system, however, will continue to face serious asset quality problems, although the government capital infusions will help Indian public-sector banks to address asset quality challenges.

The rising levels of private sector leverage and the potential asset price corrections place banks’ asset quality at risk. High and rising property prices remain a key concern across the region, especially in China, Hong Kong, Australia and New Zealand. Therefore, regulators need to step up efforts against the potential vulnerabilities.

High private sector leverage

Private debt has continued to rise over the past decade, partially due to low interest rates for a prolonged period of time. Although the financial performance of banks won’t be greatly affected in 2018, the heavy private-sector leverage poses significant challenges to the longer-term financial stability and economic growth.

As a percentage of gross domestic product (GDP), the corporate debt levels in Hong Kong and China are the highest among Asia-Pacific markets, while households in Australia, New Zealand and South Korea are most indebted. India is also exposed to high corporate leverage risks. Countries like Indonesia and the Philippines have relatively low levels of private sector debt.

Amid rising concerns, many central banks have unveiled measures to curb the build-up of private sector debt. As a consequence, the debt accumulation has decelerated in some Asia-Pacific markets. However, high private sector indebtedness remains a source of vulnerability, especially when US Federal Reserve is expected to raise interest rates further.

The deb in China has expanded at a slower pace in 2017, owing to the reforms aiming to reduce the leverage of the banking sector to curb risks. However, risks remain. Ng said that loans in China still grow faster than nominal GDP, especially in broader measures of credit, and it is too early to cheer for the success of deleveraging as China has only started leveraging slower.

Countries like Malaysia and Thailand have seen a decline in their household debt as a share of GDP, although their household debt-to-GDP ratios are still among the highest in the region. Despite the steps taken, the household debt-to-GDP ratios for Australia and South Korea continues to rise, leaving them vulnerable to future shocks.

Profitability and liquidity concerns in China

Chinese banks will find them harder to maintain their profit growth. The tighter regulations, including those on banks’ interbank investment and financing and off-balance sheet assets, will hit Chinese banks’ income, especially for smaller banks. Given the still strong growth in balance sheets, banks’ return on assets and return on equity are expected to go down.

The smaller Chinese banks record higher loan to deposit ratios and rely more on short-term wholesale funding. The higher cost of funding leads to reduced net interest rate margin. Meanwhile, they have larger exposure to shadow banking and face capitalisation pressures from asset-quality issues and strong credit growth.

“Monetary policies and regulations have frozen liquidity and interbank activities, and this will continue in 2018,” said Ng.

China Banking Regulatory Commission (CBRC) issued draft rules on commercial banks’ liquidity management to improve banks’ risk assessment framework in December 2017. CBRC said that interest rate liberalisation and financial innovation continue to deepen and the interconnectedness of financial institutions has increased, making it easier for liquidity risk to spread and transfer in the banking system. The new rules will take effective on 1st March 2018. Three new quantitative indicators on banks’ liquidity risks will be introduced, namely the net stable funding ratio, the high-quality assets adequacy ratio and the liquidity matching ratio, which will apply to commercial banks of different scales.

The impact of IFRS 9

Increasingly stringent banking regulations will strengthen the banking sector, although banks are facing pressure to meet the higher requirements. IFRS 9 is one of the most significant changes in banking regulations, which will increase banks’ risk management capabilities and model sophistication and improve transparency.

IFRS 9 requires banks to set aside provisions against expected credit losses over the next 12 months for performing loans (stage 1), and provisions against lifetime expected losses on underperforming loans (stage 2) and non-performing loans (stage 3).

In 2018, the impacts of the introduction of IFRS 9 in most Asia Pacific markets won’t be significant, partially owning to transitional arrangements. Most banks hold excess loan loss reserves, which will help banks meet higher provisioning. Only a modest decline in banks’ common equity Tier 1 ratios is expected in 2018.

However, the implementation of IFRS 9 will have wide-ranging effects on regulatory reporting and disclosure requirements, including data sourcing system, processes and control requirements. Significant work is needed to adopt the new standards, and more advanced markets are believed to be better prepared.

In conclusion, despite ongoing uncertainty, the outlook for Asia Pacific’s banking sector brightens in the short term. Risks persist, and thus more needs to be done.

Categories:

Keywords:IFRS 9, GDP, Asset Quality, Capitalisation, Banking Outlook, Data And Analytics, Transaction Banking