Shengqiang Chen, chief executive officer of JD Finance, the financial subsidiary of JD.com, one of the largest e-commerce companies in China, discusses the company’s relationship with banks and retailers, how it has evolved as a financial technology organisation, and its future plans.

October 25, 2017 | Emmanuel Daniel- Shengqiang Chen shares how JD Finance’s strategy evolved as a fintech player in China

- Chen believes that by offering various financial products, such as credit cards and mutual funds, JD Finance is able to get the trust of banks

- JD Finance aims to elevate itself as a global tech company, being able to provide what clients from different countries need

Emmanuel Daniel (ED): All of us have seen how JD Finance has grown out of JD itself. Under your leadership, we want to get a sense of the personality that you are putting into JD Finance that might be different from JD itself.

Shengqiang Chen (SC): We have gone through two different periods in terms of strategy. JD Finance was established on October 18th 2013, before that time I was chief financial officer (CFO) of JD.com. Then I became chief executive officer (CEO) of JD Finance, and we started doing internet finance with our own money. That was phase one of JD Finance. In 2015, I started considering the future of JD Finance. In September of 2015, we gave it a new definition—a financial technology (fintech) company. Back then, no one used the term in China. But how we understood a fintech company then was no different from phase one. We thought fintech meant using technologies to do financial business. We didn’t start genuine transformation until 2016. In 2016, we stepped into phase two—to be a fintech company, a tech company that serves the financial institutions instead of developing technology to conduct financial business, which is our current positioning.

JD Finance’s evolution as a financial technology company

ED: Something that we found happening in China is that many of the so-called fintech companies want to be seen as respectable in the financial industry. The peer-to-peer players, the peer-to-peer investment companies and lending companies, and payment companies, all of them call themselves fintech. In fact, one of the reasons why I wanted to meet you is that you’ve made comments about fintech and you are very critical about it. This year we’ll be publishing our own assessment of fintech players. Of course, there are at least three different types of fintech players. The disruptors, the ones that are not asking permissions from the banks to revolutionise the industries; the partners; and the IT companies but called fintech. And 80% of these players are just IT companies.

But in the space of collaboration, it’s very interesting that some of the players, especially peer-to-peer are looking for opportunities to work with the banks. So the purpose of meeting you is to get a sense how do you position JD. Actually, the sense we get is that Alibaba has built a very strong mutual funds business when it first entered the financial space, whereas in your case the payment part is stronger. Maybe you can explain to us a little bit about the DNA of JD Finance, its origins, and where you are taking it to.

SC: Let’s start from the clarification of the industry, as you’ve mentioned, dividing the industry into three categories. In my definition, the first is the “techfin”, the companies which conduct or mainly conduct financial business and will continue the financial business in the future; the second is the “fintech”, the companies which intend to serve financial institutions with new technologies; the third is the traditional IT companies which serve financial companies but with different models. For those IT companies, the handover of the system means the end of the transaction; while it means the beginning to us.

As I’ve mentioned during an event in September, we define ourselves as a fintech company. The premise of that is we provide enterprise services to financial institutions instead of conducting financial business. The purpose of our own financial business sector is to prove to the financial institutions our capability. In the future, we will hand over those businesses to financial institutions, and we will provide them with customers, technologies, and risk control system. We are more like a partner to the financial institutions instead of a vendor. The relationship between financial IT companies like IBM is more like a seller to buyer relationship.

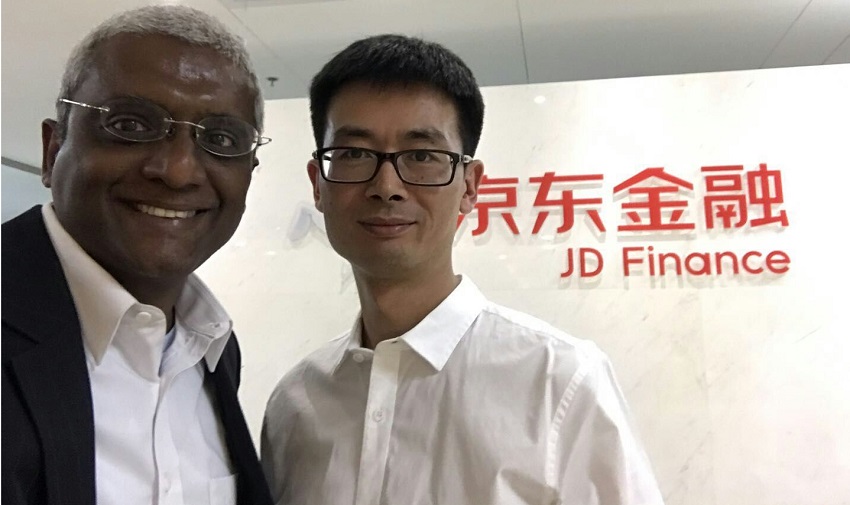

Emmanuel Daniel, chairman of The Asian Banker, and Shengqiang Chen, CEO of JD Finance

ED: I know that you worked with one of the big four banks—ICBC. The banks themselves are trying to do what you are doing, at the same time they collaborate with you. Because I’ve seen what the banks are doing on the inside, they are beginning to look like you. There’s a phrase in English: “Keep your friends close, but keep your enemies closer.” I have the sense that banks are collaborating with you just to make sure that they are in touch with what you are doing. Do you think that this collaborating relationship with banks is a temporary position because the regulators themselves do not know how to regulate you?

SC: It’s all about why you started your business and what you want as well as what the banks want; the answers will decide whether we are friends or enemies. So, the definition of your company is very important and it explains everything. If you plan to keep doing financial business, you will definitely be an enemy to the financial institutions. But I don’t want to do financial business in the future, and I am not saying that because I want to collaborate with financial institutions right now.

Last year, I explained to the team why we do fintech. The biggest barrier for the development of finance is capital: how much money you have, leveraging that money, and how much loan you can issue. Technology is only a tool to increase efficiency and decrease cost and risk; it’s not the biggest barrier for finance. For a company like us, we don’t need to finance and earn capital gain. We are good at technologies, and data, and the new understanding of finance. Only if we conduct what we are good at will we have a future.

The industry doesn’t lack financial companies with strong tech ability, but lack one that has clients and can bring the clients and technology to the banks, because most companies with clients want to conduct financial business themselves for profit maximisation. But doing so creates a clear upper limit. Only by collaborating with financial institutions (FIs) that you can get the opportunity to break the upper limit. So, it’s a long-term competition and a long-term collaboration. Whether we can win the competition and whether the collaboration could last depends on whether we can bring true values to the banks.

On October 16th 2013, I was in Richard Liu’s (founder of JD.com) home in New York, and I asked what his requirements were for me in terms of JD Finance. He said there are two requirements. The first is to do the things with long-term value, which means the most difficult things in the industry, so we chose risk pricing as the core of JD Finance. The second is to share, if we can make a $15.08 (RMB100) profit, we can only keep $10.56 (RMB70) and share the rest with our partners or staff.

So, the end of our collaboration with FIs is the maximum profit of the whole industry. We can help FIs to increase profit and efficiency, and decrease cost. What we are good at is different from what FIs are good at. We can better understand the millennials who are actually the potential growth of banks’ customer end business.

As for the business end, banks often serve large companies. They don’t have the ability to serve small and medium-sized enterprises (SMEs) well. Because for the big banks, it takes the same procedures and cost to issue a one-million loan and a one-billion loan. They can’t cover the cost when issuing loans to SMEs. But we can, as we have almost no marginal cost or variable cost by using technologies instead of human to operate. So, we are different in models, which makes us capable to serve them. If we are willing to give up the financial business, we can be good partners.

ED: Actually, I was about to ask you about your own personal journey, from a CFO to a CEO, and your answers are actually telling me the story. Let me ask you very directly, was there ever any temptation to apply for a banking licence?

SC: Actually, we will apply for the banking licence for the use of defence instead of attack. If some of my businesses that require banking licences, I will apply for one, but that doesn't necessarily mean I will conduct banking business.

ED: And also the People’s Bank of China (PBOC) and China Banking Regulatory Commission (CBRC) are thinking of special banking licence for internet banks, maybe that is different from the regular banking licence.

SC: Maybe.

Strengthening JD Finance relationship with banks and retailers

ED: You've actually positioned JD Finance separately from JD.com and separately from banks, so you are in between JD.com and banks. The advantage that JD.com has is it's got a lot of information on customers, while banks have a lot of information of customer finance, but not customer lifestyle. At the same time, banks have gone through a full experience on how to outsource their IT, long before the internet revolution. The banks looking at JD finance are very attractive to your technology but also jealous of the customer relationship that JD has. How would you describe your working relationship today based on what you want to achieve?

SC: Our large customer base is actually also for the banks, because they can provide the financial services to our customers. I don’t want to do financial service, I want to serve the financial institutions, to provide them with JD’s clients, operating ability and our understanding of the clients.

ED: Give us an example of your working relationship right now. One of the problems is that the big banks in China also have a very large IT team, so the thinking of the IT department of banks is like an IT company.

SC: As I’ve mentioned, it’s very important to define the industry. There are three types of companies. The first is techfin; the second is fintech; the third is the traditional IT companies like IBM. Some domestic banks have IT departments large enough to become IT companies, including ICBC. But the difference between them and us is that, they can only provide the system, but we can provide a series of things, including the system, customer, and operating abilities.

ED: But you are not about to hand over your own customer knowledge to the banks.

SC: The final target is we will share the clients together, which means the banks can provide their financial products and services to JD's clients.

ED: But you almost have the same product sets now, you have a credit card, you have mutual funds, you bought a security company, and you are beginning to look like a bank.

SC: Because we have to prove that we can serve our clients well. If we just ask ICBC to collaborate with us and use our risk control system, they wouldn’t even look at us. Only if we prove to them by issuing loans and collecting the money back will make them trust our capacity. And in the future, we will gradually withdraw from the financial business.

ED: I'm still not convinced. It’s a proof of concept, understand, but you are mirroring the business of the banks. Actually, long before JD, banks had a history of trying to use third-party partnership like this before. And I'm actually thinking about the previous experience of banks. Let me ask you this question: Do you think that the origination model might work better for you because you have a strong understanding of the customer? The only part of the banking that you probably don't like is the capital requirement. And if you are able to originate the products and pass the asset to the bank so you don't have to have the capital, would that be more attractive to you?

SC: Actually this is one of our models. We have different models while collaborating with different banks as they have different demands. Our products are like Legos, banks can build different Legos according to their demands.

Positioning JD Finance in an era of globalisation

ED: Describe a little bit to me about the relationship between JD Finance and retailers, like Walmart, like in Thailand you have a new relationship with the Central Group.

SC: We are partners with the domestic retailers heading to a win-win relationship. In Thailand, we set up a joint-venture company with the Central Group, and it will provide fintech services in Thailand.

ED: Are you growing this model increasingly with other traditional retailers not only in China and Thailand? Are you also thinking about different countries as well?

SC: Globalisation will be one of our key strategies next year, which is influenced by the development of China. Five or ten years ago, when we look at Chinese internet companies, for every company you can find its US counterpart because they are all copying from the US. But this has completely changed. China has developed into a world leading position in terms of innovation of business models and technologies, the activeness of innovation, the environment of innovation, venture capital, efficiency, and the tech staff.

JD’s drone could fly 240 kms, which could lead the world. Our driverless truck only needs one manual intervention every 500 kms. China is leading the world in terms of technology. In China, we are living extremely convenient lives. There are only foreign currencies in my wallet because I don’t need cash to survive in China. I can use my phone to call cabs or order takeaways. The current China can not only output capital, it can also output business models and technology. It’s time for a Chinese global company. So, we don't regard us as a Chinese company, instead we regard ourselves as a global tech company.

ED: Yes, you have an innovation centre in Silicon Valley…

SC: Yes, and in the future we will not only have an innovation centre in Silicon Valley, but also in Europe and Israel.

ED: Which are your desirable countries that you want to succeed in?

SC: I don't have any desirable countries to succeed in actually. It’s like when people ask about which one of the many business lines is the most important to me, I can't answer that. I provide what the clients need and that's it. It’s the same for the countries. We provide what the country needs instead of categorising the countries and deciding which countries are more important and deserve more efforts. We need to have different strategies for different countries, as the financial environment and regulations differ, instead of using the same model for every country. We want to act like start-ups when globalising and design products according to the local demand of other countries. What we can provide is to enable the globalisation team by giving them our experience, system, data, and ability.

ED: How did your relationship with Walmart in China come about?

SC: Our partnership with Walmart hasn't started for very long time. At the beginning the partnership is more on the e-commerce side, and it might shift to JD Finance in a later stage.

ED: What is the purpose of running JD Finance separately from JD now? Is it because of listing requirements or is it because of business strategy?

SC: Because we might apply for a banking licence as a defence. Being an America-listed company might have some negative influence on it due to the regulations.

ED: With your instinct as a finance person, one of the concerns we have when we talk to a lot of start-ups, or peer-to-peer lenders in China is that they grow their loan book very fast, in two years, it can become $10 billion. How do you think about customer risk or consumer risk? And what is so special about JD Finance that you think you control consumer risk very well?

SC: In the financial industry, the risks are delayed compared to the gains. It’s easy to issue ten-billion loans, but it’s difficult to collect the money back. And it’s very important whether your loans go to enterprises in need or inclusive finance, or you are just earning high interest. Since the very beginning, we regard the risk pricing as our core capacity. We have 4,000 staff in total – Among them 2,000 are related to technology, data, and risk control; 800 are customer service; and only 1,200 are business staff and supporting teams. And it is because our risk pricing ability that the FIs collaborate with us. Take the Xiao Bai Xin Yong(小白信用)as an example. It’s an individual credit product. It covers over 300 million users, and our system have over 30,000 variables for each of them when rating their credit. The system will decide different loan amount, interest rate, and maturity for each individual. There are only a few organisations able to do that globally. Additionally, we are keeping the interest rate at a relatively low level, instead of covering high bad debt rate by charging high interest rate.

ED: What is your criticism about the way the traditional banks manage their customer data today?

SC: I think traditional banks have the financial data of their existing clients, but they lack the data and the technology which can help them better understand the clients. For example, when I'm using my phone, it takes technology to tell whether it's me using the phone or not. We can tell whether it's the owner using the phone or not by analysing the way he slides and the pressure to the screen. So down here on earth, we are a tech company. We were established in 2013, and started to do risk control model using advanced technologies like AI in 2014. As mentioned, we have over 30,000 variables for each individual, which can’t be done by human.

ED: You've answered most of my questions, but what's interesting is, this is a journey, so the answers that you give me today, I'll be very curious to know how that's going to be evolving in the next few years.

SC: What I mentioned today, most of them are already realised. JD is more of a doer than a talker. I only started to make public comments since last year, and you are the second media that has ever interviewed me, the first was Bloomberg.

ED: Thank you for that. You just bought a security company, what are you learning from the security industry?

SC: It's a rumour.

ED: Is security your next thing?

SC: We have our own security department, but our emphasis is on the technology part.

ED: We take a very serious view of the business itself; we are not a news company, we actually run rankings. We are very afraid when certain businesses grow too fast, we want to understand whether it's based on sustainable models, something you mentioned what you do with data, I took note of it. Thank you very much.

SC: Thank you.

Categories:

Financial Technology, Innovation, Technology & OperationsKeywords:JD Finance, JD.com, Fintech, Techfin, Regulation, Payments, SME