Big four banks to tidy up various messes coming from renewed pressure from regulators

August 27, 2019 | Chris Kapfer- The largest Australian banks have built powerful digital banking platforms that compensate the repercussions from the banking crisis and incoming new entrants

- Digital banking users continue to express confidence in those platforms

- Early user data from neo-banks are not convincing that consumers will give their customer mandate to neo-banks

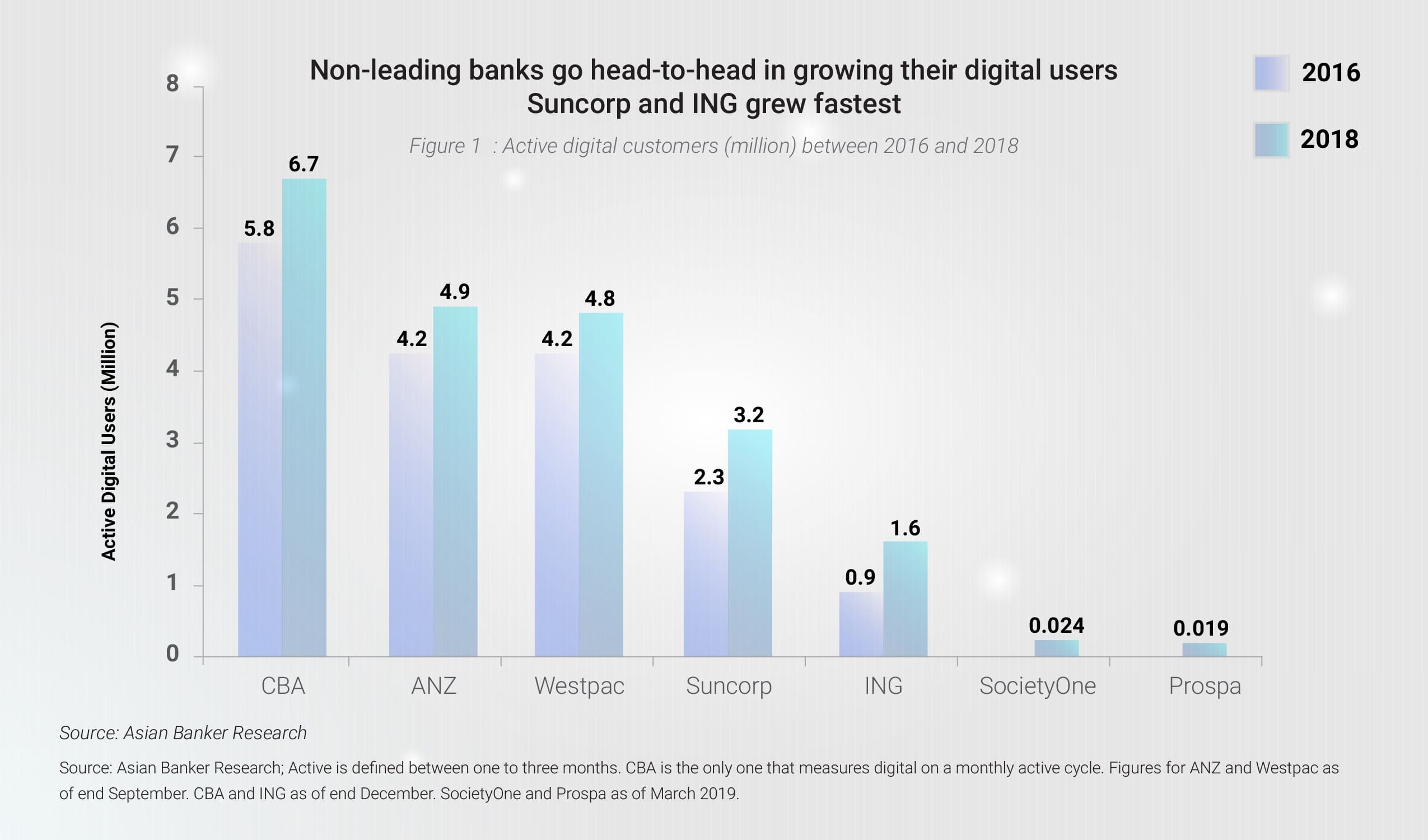

After the big four banks in Australia, namely Commonwealth Bank of Australia (CBA), ANZ, Westpac, and National Australia Bank (NAB) have seen a steep decline in their net promoter score (NPS) – an index measuring customer loyalty among consumers – the digital user growth in 2018 across banks has yet to reveal a clearer picture whether the digital active part of consumers will make the switch.

ING, the country’s fifth largest home loan lender, has more than doubled its customer acquisition from 163,000 customers in 2016 to 400,000 customers in 2018. Of the 700,000 interactions ING has with its 100% digital customers each day, 70% of that is through the mobile apps. While the big four are scaling back their product suite, simplifying their structure and processes, ING introduced five products in the last 18 years. Besides mortgages, checking and savings accounts, pension products and superannuation, it entered into personal loans in 2018.

In comparison, Up, the first fully-licensed and cloud-hosted digital bank of Bendigo and Adelaide Bank and the country’s sixth largest bank by assets, reached 20,000 users between its launch in October 2018 and December 2018.

Changes in the competitive nature of the industry come at a time when the incumbents are already one of the most digitised commercial banks in the Asia Pacific. Seven out of 10 banks in Australia allow new bank customers to open a current account via mobile banking.

D...

Categories:

Keywords: